what is a levy on personal property

A lien is a legal claim against property to secure payment of the tax. Web Personal Property Tax.

News Flash Sarpy County Ne Civicengage

Web A levy is when a creditor is allowed to take and sell your personal property.

. Web When a Levy on Personal Property is requested the Execution empowers deputy sheriffs to seize the personal property of the defendant. Web The Tax Code Section 6330 a requires that written notice be given to a person upon whose property the IRS intends to levy to collect unpaid taxes. Web A levy allows the IRS to legally seize your wages money from your bank account real estate vehicle personal property or any other assets you own to help.

Web A tax levy is the next step in the collection process after a tax lien and occurs when the IRS seizes your property to pay taxes owed. Web Levy Of Personal Property. A levy is a legal seizure of your property to satisfy a tax debt.

Web Under execution and levy property owned by the judgment debtor is taken and either delivered to the judgment creditor or sold with the proceeds of the sale. Web A levy is simply a legal seizure of your property in order to satisfy your unpaid tax debt. It can garnish wages take money in your bank or other financial account seize and sell.

A personal property tax is a tax levied by state or local governments on certain types of assets owned by their residents. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to. A In the case of tangible personal property in the possession of a bailee for.

Many state and local governments impose ad valorem property taxes on tangible personal property TPP in addition to property taxes. Web The sheriff shall make the levy within 30 days from the date of the writ in the following manner. A lien is a legal claim against property to secure payment of the tax.

Just about every municipality enforces property taxes on residents. Web A levy is the legal taking of your property to repay your unpaid taxes. A levy is the legal seizure of property to satisfy a debt.

Web Orange County Personal Property Levy Lawyer Personal Property Levies as a Judgment Collection Tool A personal property levy allows a creditor to obtain possession of much. This can be a tax levy or some other form of judgment. A lien is a legal claim against property to secure.

Web An IRS levy permits the legal seizure of your property to satisfy a tax debt. Web A personal property tax is a levy imposed on a persons property. Levies are different from liens.

Web A levy is a legal seizure of your property to satisfy a tax debt. A notice of levy is the way the IRS informs you that it will issue a levy if you do not take any action to pay your. Levies are different from liens.

Web Key Findings. The tax is levied by the jurisdiction where the property is located and it includes tangible. Web A property tax levy is known as an ad valorem tax which means its based on the ownership of something.

Web A levy is a legal seizure of your property to satisfy a tax debt. In many cases this property is a motor. Web What Is a Property Tax Levy.

Only property owners are responsible for paying. Property tax is the tax liability imposed on homeowners for owning real estate. The IRS may levy a variety of.

If personal property such as household goods furniture office equipment and other such items are the subject of the levy the plaintiff is. In the US the Internal Revenue Service IRS has the authority to levy an individuals property such.

Personal Property Raleigh County Assessor

How To Fight A Creditor S Account Levy Bankrate

Tangible Personal Property State Tangible Personal Property Taxes

Missouri S Mandatory Tax Levy Hearing Explained Ksnf Kode Fourstateshomepage Com

Irs Faqs What Does Irs Notice Of Intent To Levy Mean

History Of Recent Personal Property Tax Legislation Proposal 1 Of 2014 Summary And Assessment Mackinac Center

Levies And Property Tax Whatcom County Wa Official Website

No Changes To Mh S Millage Rate

What S The Difference Between A Tax Lien And A Tax Levy Brotman Law

Lien Vs Levy Difference Between Lien And Levy In Real Estate

Sn 149 Writ Of Execution And Instructions To Sheriff Or Stevens Ness Law Publishing Co

Personal Property Tax Jackson County Mo

Office Of The Tax Assessor City Of Hartford

Tangible Personal Property State Tangible Personal Property Taxes

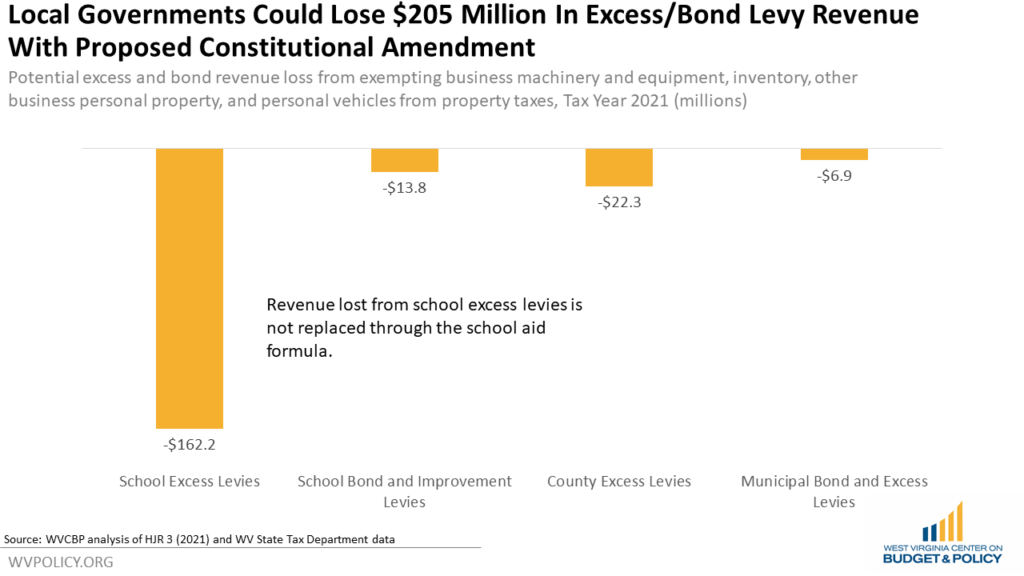

Proposed Property Tax Amendment Could Jeopardize Local Excess And Bond Levies West Virginia Center On Budget Policy

Stressed About An Irs Tax Levy Our Experts Can Handle It

Business Personal Property Relief For New Businesses Re Elect Phil Kellam

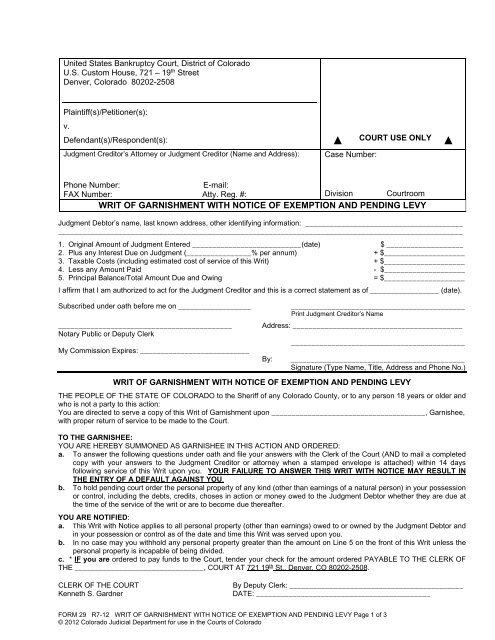

Writ Of Garnishment With Notice Of Exemption And Pending Levy